Instantly Generate Professional Pay Stubs

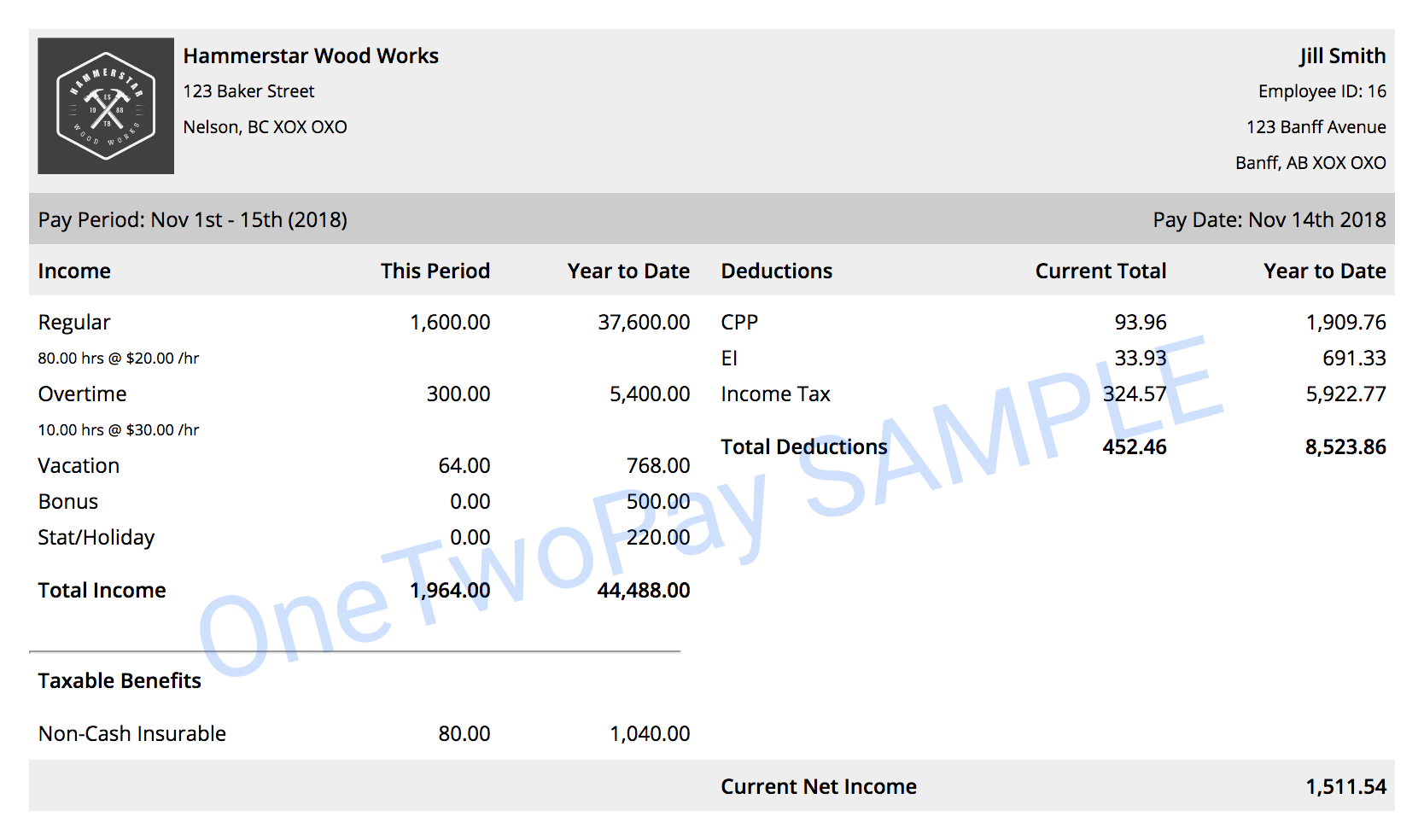

Tax, CPP and EI Deductions Calculated For You

Save employee information and auto-generate pay stubs

Upload your own logo

Let OneTwoPay calculate the deductions for you

Get a summary of employer and employee remittances

Generate a T4 report to help with completing T4s

Add cash and non-cash taxable benefits

Add year-to-date income and deductions

Preview your pay stub before purchasing

Email pay stubs to yourself and forward to your employees